rhode island income tax withholding

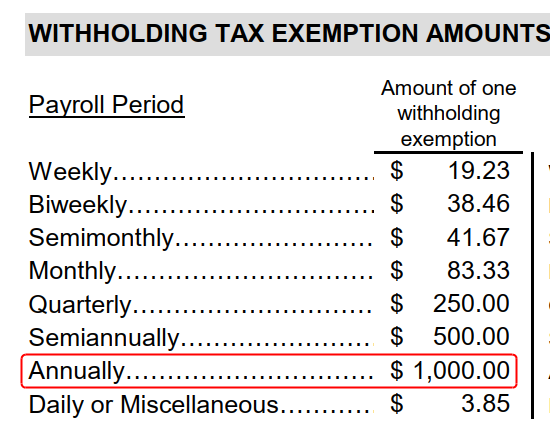

The annualized wage threshold where the annual exemption amount is eliminated. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three.

Powerchurch Software Church Management Software For Today S Growing Churches

The income tax withholding for the State of Rhode Island includes the following changes.

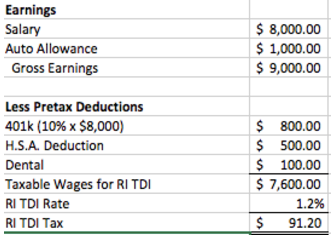

. 34 cents per gallon of regular gasoline and diesel. The income tax withholding tables in this revision are effective for pay periods beginning on or after May 1 2022. Rhode Island regulatory law provides that a Rhode Island employer must withhold Rhode Island income tax from the wages of an employee if.

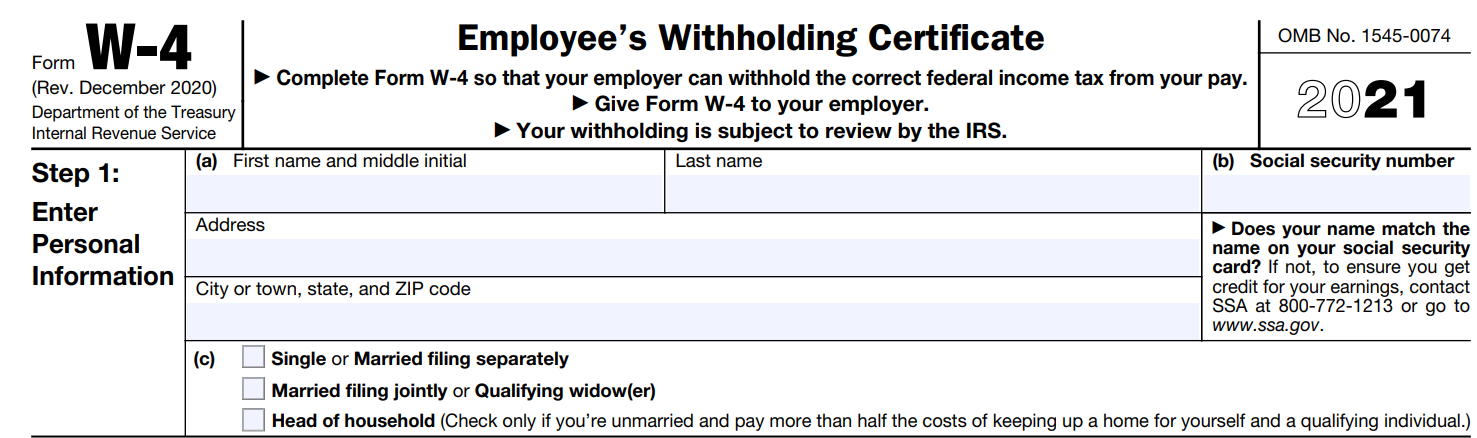

Like most other states in the Northeast Rhode Island has. Rhode Island Income Tax Withholding Certificate RI-W4 RI W-4 2022pdf. Generally Rhode Island withholding is required to be withheld from the wages of an employee by a Rhode Island employer.

Individuals filing joint Rhode Island income tax returns incur joint and several liability for the Rhode Island income tax. The annualized wage threshold where the annual exemption amount is eliminated has increased. The annualized wage threshold where the annual exemption amount is eliminated.

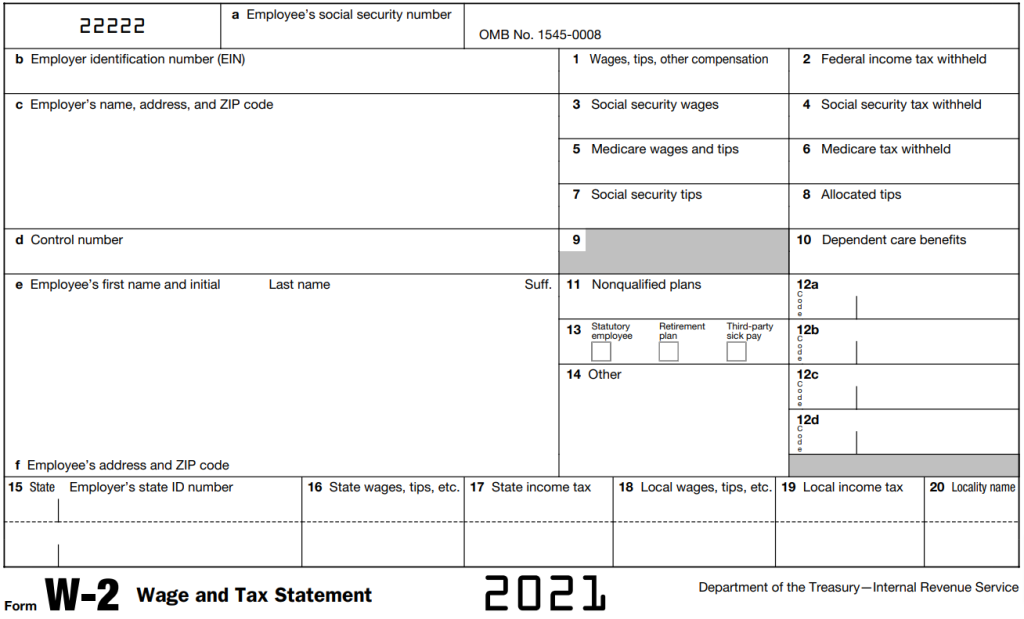

1 The employees wages are subject to federal income tax withholding and 2 Any part of the wages were for services. Withholding Formula Effective Pay Period 06 2014 Subtract the nontaxable biweekly Thrift Savings Plan contributions from the. Wages paid to Rhode Island residents who work in the state are subject to withholding.

This is a downloadable Excel spreadsheet withholding calculator tax tables all-in-one for the 2021-22-23 yearsThe tax instalment rates for 2022-23 applying from 1 July 2022 remain. Rhode Island employer means an employer maintaining an office. Hold Rhode Island income tax from the wages of an employee if.

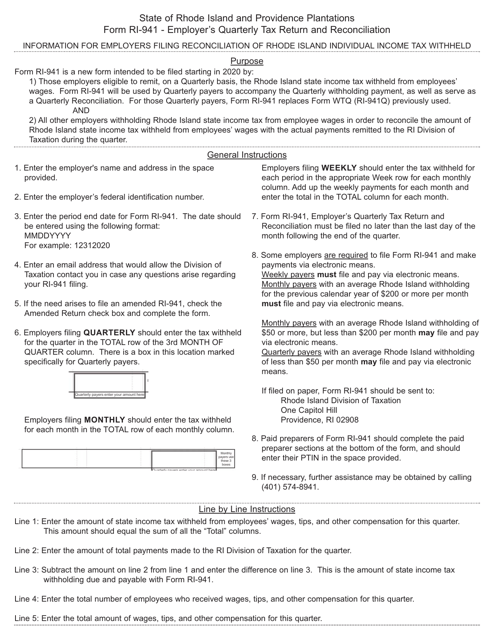

The income tax withholding for the State of Rhode Island includes the following changes. Prior Year 941Q Quarterly Withholding Return - ONLY FOR USE FOR PERIODS ON OR BEFORE 12312019 PDF file less. EMPLOYEES FROM WHOSE WAGES RHODE ISLAND TAXES MUST BE WITHHELD.

Rhode Island income tax must also be withheld from wages paid to Rhode Island nonresident. Equal the total payments made to the Division of Taxation for that year and should also equal the total amount of Rhode Island income tax. Employers withholding Rhode Island personal income tax from employees wages must electronically file andor pay the taxes withheld to the Division of Taxation on a periodic basis.

A Rhode Island employer must with-hold Rhode Island income tax from the wages of an employee if. The annualized wage threshold where the annual exemption amount is eliminated. Rhode Island like the federal government and many states has a pay-as-you-earn income tax system.

The income tax withholding for the State of Rhode Island includes the following changes. The income tax withholding for the State of Rhode Island includes the following changes. You must pay estimated income tax if you are self employed or do not pay.

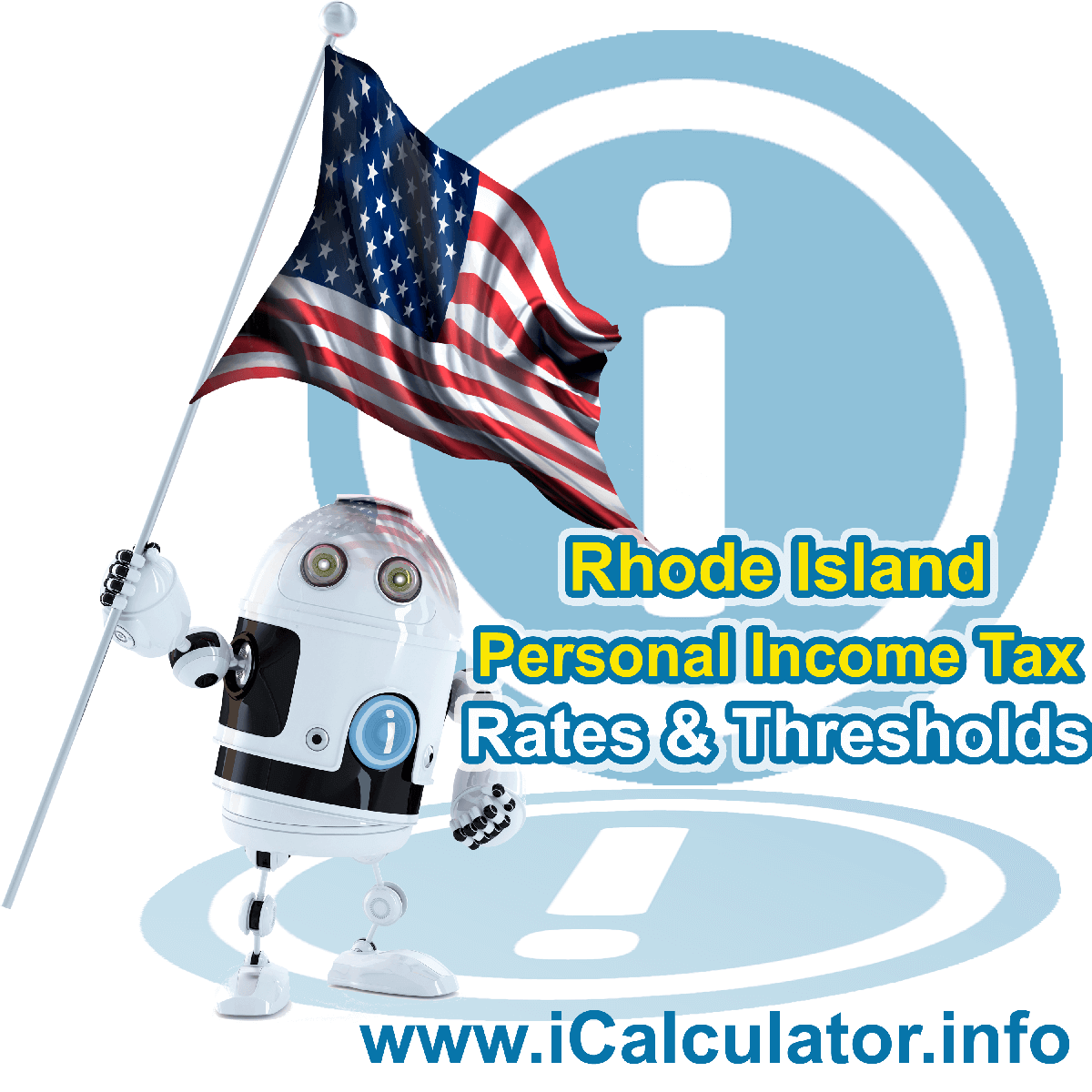

Utah State Tax Commission 210 North 1950 West Salt Lake City Utah. UMass employees who reside in Rhode Island use the RI-W4 form to instruct how RI state taxes should be. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022.

Residents and nonresidents including resident and. BAR Business Application and Registration PDF file less than 1mb. 153 average effective rate.

TAXES 14-12 Rhode Island State Income Tax Withholding. A the employees wages are subject to Federal.

Ri Extends Tax Deadline To May 17 In Line With Irs

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

How Your State Tax Withholding May Have Been Affected G A Partners

Payroll Software Solution For Rhode Island Small Business

What Is State Income Tax Charts Maps Beyond

How Are State Disability Insurance Sdi Payroll Taxes Calculated

Rhode Island Division Of Taxation 2019

Rhode Island Paycheck Calculator Tax Year 2022

Rhode Island State Tax Tables 2022 Us Icalculator

Rhode Island Division Of Taxation 2019

Prepare And Efile Your 2021 2022 Rhode Island Tax Return

Navigating State Withholding Requirements For Nonresident Employees Wolters Kluwer

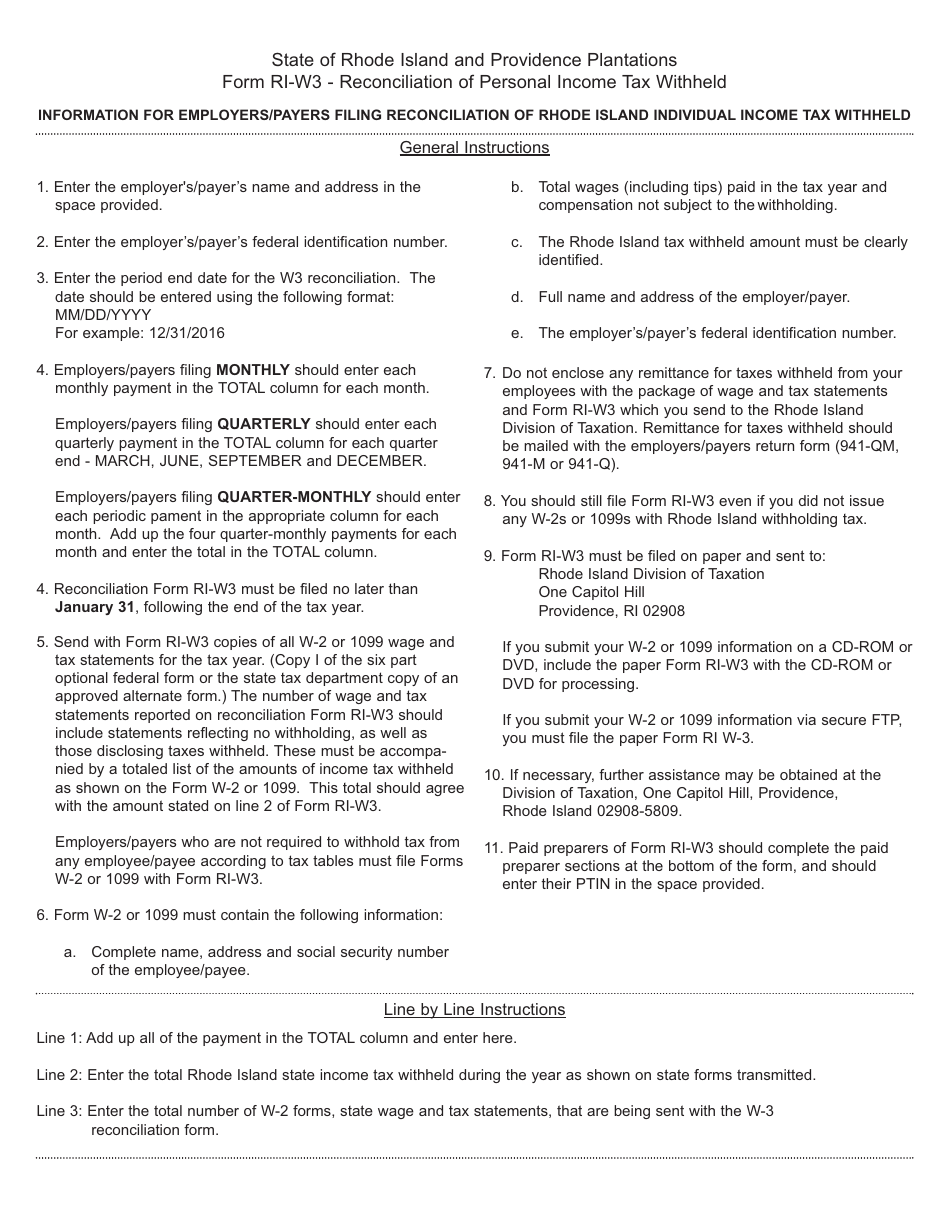

Download Instructions For Form Ri W3 Reconciliation Of Rhode Island Individual Income Tax Withheld Pdf Templateroller

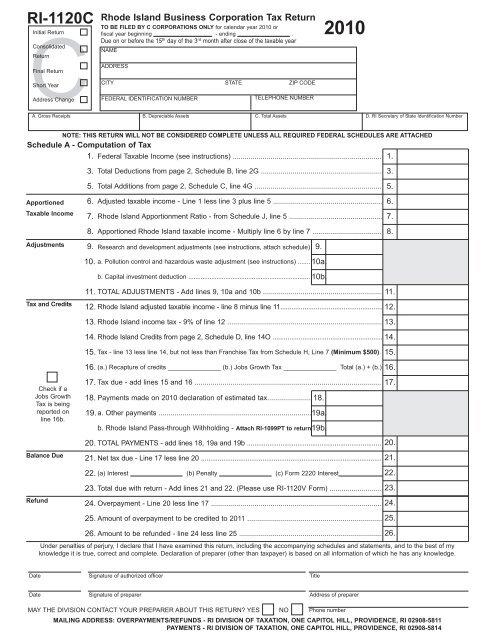

Form Ri 1120c Rhode Island Division Of Taxation

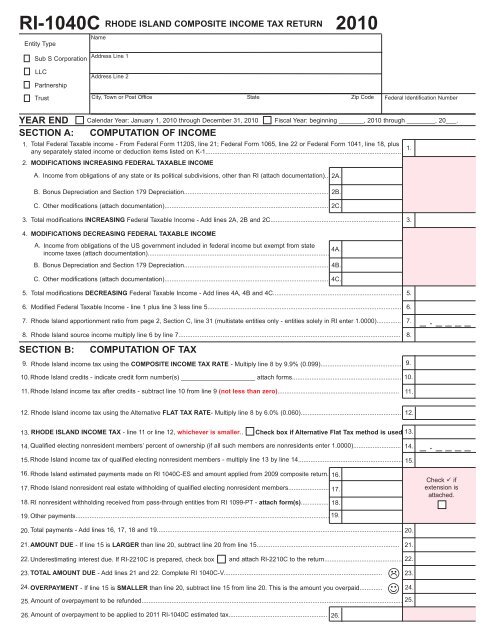

Form Ri 1040c Rhode Island Division Of Taxation

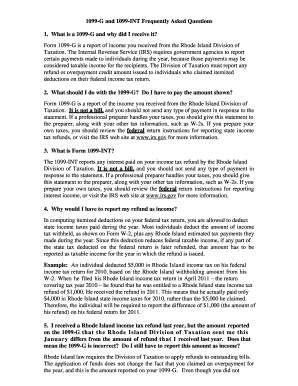

Ri State Id Number 1099 G Fill Online Printable Fillable Blank Pdffiller